Preservation Solutions

Orange County Trust and Probate Lawyer – David L. Crockett

David Crockett, attorney-CPA, Broker, has 40+ Years Experience in Litigation, Estates, Trusts, Probate, Wills, Estate Planning, Real Estate and Asset Protection.

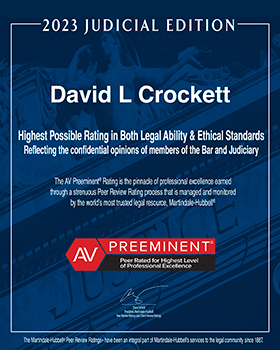

With over 40 years of experience as a Trust Lawyer, Estate Lawyer, Tax Lawyer and Real Estate Lawyer serving Orange County, Newport Beach, and surrounding communities, David Crockett, J.D., CPA, has helped countless clients with their Trust and Probate litigation, Trust formation and amendment, Probate, Wills, Estate Planning, Taxes, Asset Protection, and Real Estate issues. Mr. Crockett is rated as an “AV Preeminent” lawyer with the “highest possible rating in both legal ability and ethical standards” by the Martindale Hubble lawyer directory. He also has an Avvo rating of “Superb-10.0” in the field of trusts and estates.

Types of Work We Do:

- Trust and probate litigation

- Trust formation and amendment

- Administration of trusts and probate estates including Accounting

- Probate court proceedings

- Wills

- Estate planning

- Taxes and planning

- Real estate law

- Asset Protection

Please refer to the “Practice Areas” page of this website for a more detailed description of our legal services.

Your Situation is Probably Something We Have Already Seen and Successfully Dealt With

It is not uncommon for individuals or businesses to find themselves involved in legal disputes involving a trust or estate. Disputes such as missing assets, long delays and failure to distribute or the failure to account for money may become ugly very quickly which may result in devastating financial consequences for all parties involved if not solved quickly. We have 40+ years of experience untangling these disputes including filing court lawsuits/petitions and obtaining Court orders where needed. We have dealt with many real life situations that are likely very similar to your own current circumstances so please don’t hesitate to call and have a free initial discussion to get some direction. See Some Actual Client Stories here.

Unique Approach Because of 3 Licenses: Attorney, Certified Public Accountant & Real Estate Broker

All matters are reviewed from three points of view: Lawyer (state license # 46632), CPA (state License #25836) and Real Estate Broker (state license #01909116) . David L. Crockett’s experience and licenses allow him to provide sophisticated, practical and understandable advice and solutions. The typical estate or asset situation, usually involves a combination of legal, financial and tax questions as well as real estate marketing and operational questions. As a 3 in 1 expert, Mr. Crockett is in a unique position to provide practical and cost-effective advice in all these areas. He is familiar with and has access to most all commonly used forms for real estate deals, wills, trusts and estates. Down to earth explanations of the tax and financial aspects of any deal or estate are routine.

Crossover in Subject Areas Allows More Comprehensive Advice

Mr. Crockett personally works on three main areas almost daily: (i) Trust and Estate Litigation; (ii) Trust and Probate Administration; and (iii) Estate Planning, Wills and Trusts including accounting. Each area has its own complicated sets of laws in the California probate code, civil code, code of civil procedure, local probate court and civil court rules and the Internal Revenue Code.

Thus, when consulting with clients about estate planning & wills & trusts and such documentation, he can explain why the various documents are needed. He has prepared countless numbers of these documents and has developed up to date and unique clauses often not found elsewhere. Many of such clauses have been created because of his experience in litigation and seeing what problems can result if the documents are not adequate for the situation. He will often explain what the consequences are as far as litigation or as far as administration might be if the documents don’t adequately cover the subject matter.

When consulting on Trust and Probate administration he explains what should be done and what litigation and penalties and taxes are likely to result if the proper steps and laws are not followed. He also advises on the legal requirements for Accounting as required by the California probate code. Various government filings with county, state and federal governments are typically required and each has its own legal deadlines and consequences for late filing or failure to file. Also, legal notifications and Accountings must be provided to the beneficiaries by certain deadlines. It is not necessary to separately consult with a CPA or tax attorney about the estate Accounting and tax matters because Mr. Crockett is qualified to explain those items and to prepare the necessary forms involved.

Lastly, when consulting on Trust and Probate litigation, Mr. Crockett approaches each case from the points of view of (i) are the estate planning documents involved proper and/or understandable and legal and (ii) have there been mistakes or wrongdoing in the course of trust or probate administration, including the mishandling of money and Accountings. This type of litigation involves preparing court lawsuit/petition papers which explain the wrongdoing in detail so the Court can understand what is being complained about and what laws were broken. Because Mr. Crockett routinely prepares estate plans, wills and trusts, he can explain in papers filed with the court what is wrong and/or how the estate is being mishandled. Also, because he routinely advises trustees on administration of trusts and estates and on Accounting matters, he can boil down the essentials of wrongdoing and money mishandling in a way that the court will understand. With his ability as a CPA to prepare accountings and to prepare tax returns, he can analyze the tax returns and financial records involved and pinpoint problems. Where money is missing and/or being mishandled, Mr. Crockett as a litigator can determine what records and witnesses need to be subpoenaed and assembled to prove the case in court at the trial. Getting a handle on the money and records early on in trust and estate litigation often leads to an earlier settlement of the case short of trial.

Our Philosophy in Taking Care of Our Clients

We work aggressively to solve legal problems and create documentation and plans that function in the real world. Since we also do administration and litigation of probates, trusts, wills, estate planning and real estate situations we have a broad perspective. Documents and plans for wills, trusts, LLC’s, Limited partnerships and corporations that are not properly prepared can lead to disputes, tax problems, misunderstandings and expensive litigation. We have developed many unique checklists and written explanations to guide most clients in dealing with wills, trusts, probates, estate planning and trust administration.

Conveniently Located in Newport Beach near the John Wayne Airport

Conveniently located in Newport Beach near the John Wayne Airport; catty-corner from Fletcher-Jones Mercedes; —right behind the rear entrance of Newport Lexus on Dove Street [MAP to Office]

Give us a call and schedule a no cost Introductory meeting right now (949) 851-1771

Practice Areas

Orange County Estate Planning Lawyer Blog

Client Reviews

David Crockett has truly been a trusted asset for business and family trust matters for my parents for more than thirty years. In my dealings with him through the years allowed for a natural transition for Mr. Crockett to become my attorney for both business and family trust matters as well. I have...

Hi David I want to thank you for your time and effort, you did an excellent job and you produced great results. You are a 1st class lawyer with no B.S. just straight up facts. Again we really appreciate you for all your time and hard work. I hope you are having a fantastic life. We Love You!

Crockett Law was informative and prompt in helping my family resolve our parents’ estate. He was also a great coach to me as the trustee when it came to responding to family member questions.

Mr. Crockett’s depth of knowledge and experience has been of enormous help to our family over the years in a wide range of areas. For our real estate business investment David advised us on asset protection and established our corporation. David was always there to help us with real estate issues...